General Outlook of the Past and Coming Week

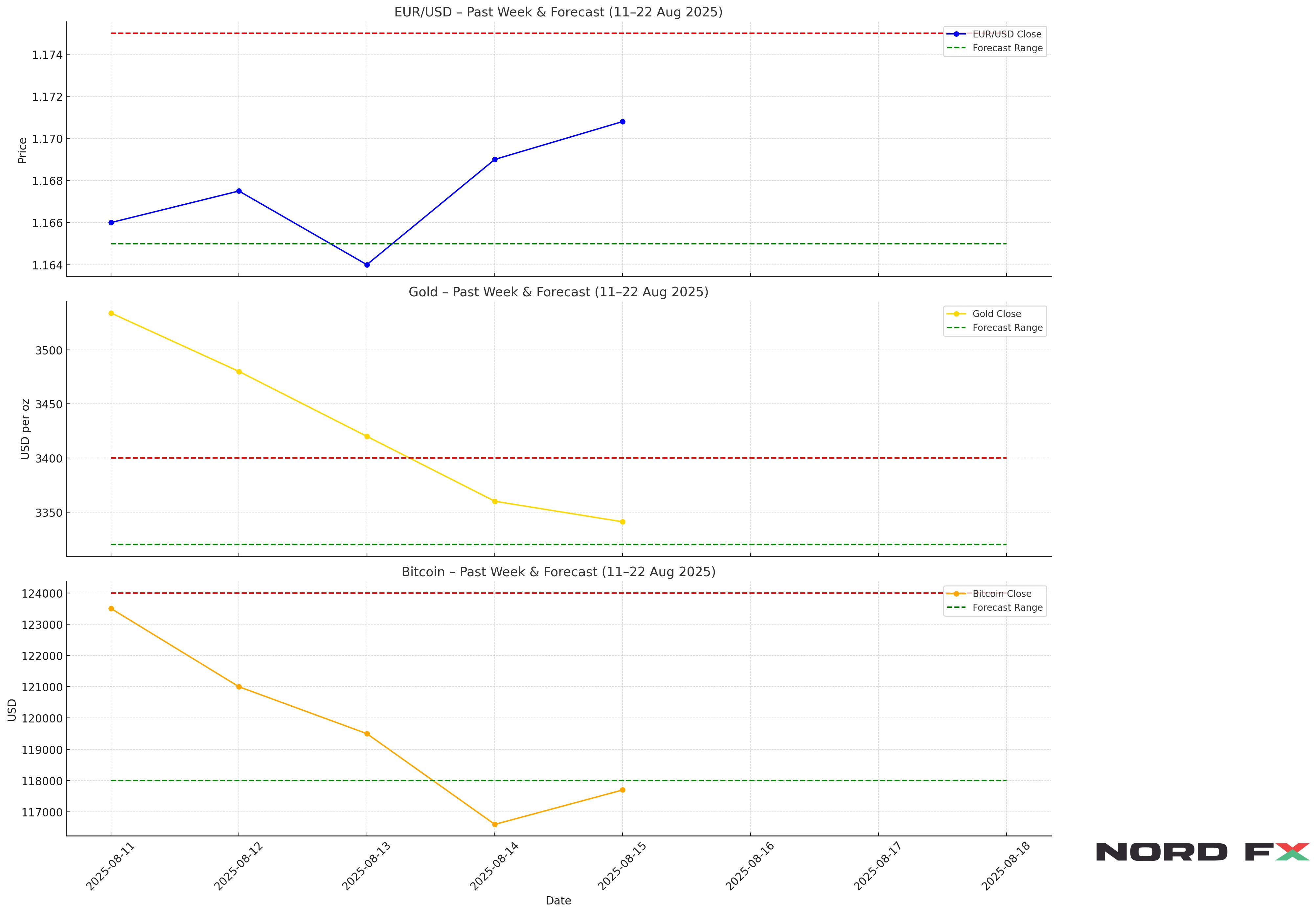

The week ending 15 August 2025 brought cross-currents across major assets. EUR/USD finished close to 1.1708, holding the upper end of its recent range as the dollar softened late Friday. Gold eased and hovered around $3,341–3,342 per ounce into the close, as hotter US producer prices trimmed expectations of aggressive Fed easing. Bitcoin printed a new all-time high above $124,000 on 14 August before consolidating toward the $117–118k area by the weekend.

Looking ahead to 18–22 August, the euro’s path looks data-dependent, gold appears range-bound after last week’s pullback, and bitcoin is likely to consolidate after the record high unless a fresh catalyst emerges.

EUR/USD

EUR/USD ended Friday near 1.1708. Bulls will eye 1.1750–1.1800 as the next resistance band, while a slip back under 1.1650 would risk a move toward 1.1600. Positioning is finely balanced and sensitive to incoming US data and Fed rhetoric after July PPI underscored lingering price pressures.

XAU/USD (Gold)

Spot gold traded around $3,341–3,342 on Friday, with the week showing a mild decline as firmer US inflation indicators tempered hopes for larger near-term rate cuts. Initial resistance is seen near $3,360, then $3,400–3,420 on a clean break higher. On the downside, watch $3,320 as first support, with $3,280–3,300 below if momentum weakens.

BTC/USD (Bitcoin)

Bitcoin set a record high above $124,000 on 14 August and then cooled, with spot closing the week around $117,600–117,700. Near-term support is $118,000 and then $115,000. Resistance sits at $123,000–$124,500; a decisive break could open $130,000. The backdrop remains broadly constructive, but after a fresh high, consolidation is typical.

Conclusion

For 18–22 August, EUR/USD is likely to oscillate inside 1.1650–1.1750 unless US data drive a breakout. Gold looks set to consolidate within roughly $3,320–$3,400 unless yields and the dollar shift materially. Bitcoin is digesting gains after its new peak, with $118,000 support and $124,000 resistance the immediate markers.

NordFX Analytical Group

Disclaimer: These materials are not an investment recommendation or a guide for working on financial markets and are for informational purposes only. Trading on financial markets is risky and can lead to a complete loss of deposited funds.