EUR/USD: ECB and Trump Pushing the Pair Towards 1.0000

● On Thursday, 17 October, the Governing Council of the European Central Bank (ECB) decided for the third time this year to lower its three key interest rates, this time by 25 basis points. As a result, the deposit rate now stands at 3.25%, the main refinancing operations rate at 3.4%, and the marginal lending facility rate at 3.65%. These changes will take effect from 23 October 2024. It is worth recalling that at the previous meeting in September, the regulator also reduced the key rates by 25 basis points.

The ECB explained its decision by referring to a revised inflation forecast, core inflation trends, and the effectiveness of monetary policy transmission. According to Eurostat, inflation in the Eurozone fell to 1.7% in September, the lowest level since April 2021. Inflation is expected to rise slightly in the coming months. Therefore, as stated by the ECB leadership, the regulator intends to keep rates at restrictive levels for as long as necessary to sustainably achieve the 2.0% target. This is expected to happen by the end of 2025.

● The results of the current Governing Council meeting were not a surprise, as the decision to lower borrowing costs fully aligned with market expectations. The EUR/USD pair reacted with a slight, momentary drop to 1.0810, but there is no doubt that the euro "bears" will attempt to push it even lower.

Experts predict that the ECB will continue lowering rates at each meeting until March 2025, after which the pace of easing may slow down. Undoubtedly, the dynamics of EUR/USD will also be influenced by the pace of monetary policy easing by the US Federal Reserve. At the moment, the key interest rate on the dollar stands at 5.0%, giving the US currency a significant advantage over the euro with its 3.4%.

● The likelihood of the dollar reaching parity with the euro is increasing amid concerns over a potential global trade war, should Donald Trump win the US presidential election. As reported by Bloomberg, Trump indicated that the United States' tariff measures could be directed against Europe, China, and other countries. In response, ECB President Christine Lagarde warned that any barriers could pose a "risk of exacerbation" for the already struggling economy of the bloc.

Coupled with the interest rate cut on Thursday, 17 October, this caused a further decline in the euro, which is ending its third consecutive week of losses against the US dollar. Additionally, this week saw the largest decline in the euro against the British pound this year.

● Currency strategists at Pictet Wealth Management believe that "EUR/USD parity is definitely possible if Trump wins and imposes large-scale tariffs." Analysts at J.P. Morgan Private Bank and ING Groep NV also do not rule out the risk that the common European currency could reach the 1.0000 level by the end of the year. This sentiment is supported by data from the options markets, where participants are increasingly betting against the euro.

As of the time of writing this review (18 October, 12:00 CET), EUR/USD is trading around 1.0845. The one-month risk reversal indicator for the pair has reached its most negative level in the past three months, reflecting traders' willingness to bet on further weakening of the euro.

● Next week, Thursday, 24 October, promises to be quite eventful. A flood of business activity data is expected on this day. The PMI index figures for various sectors of the economies of Germany, the Eurozone, and the United States will be released. Additionally, as is customary on Thursdays, the number of initial jobless claims in the United States will also be announced.

GBP/USD: Victory Over Inflation – Defeat for the Pound

● The report released a week earlier by the UK's Office for National Statistics showed that the country's GDP grew by 0.2% (m/m) in August. Thus, the UK economy returned to growth after two months of stagnation. However, when looking at the annual dynamics, the slowdown in the second half of the current year becomes evident.

On Wednesday, 16 October, another batch of macroeconomic data was published, showing that inflation in the UK fell to its lowest level in more than three years. The Consumer Price Index (CPI) on a monthly basis remained flat at 0.0%, which is below both the previous figure of 0.3% and the market expectation of 0.1%. On an annual basis, with a forecast of 1.9%, consumer prices actually rose by 1.7% in September, significantly lower than the previous 2.2%. Experts note that the drop was mainly due to declining airfares and petrol prices.

● Thus, for the first time since 2021, inflation has fallen below the Bank of England's (BoE) 2.0% target, strengthening market expectations of a key interest rate cut for the pound at the regulator's next meeting. It is now anticipated that on 7 November, borrowing costs will be reduced by another 25 basis points, from 5.0% to 4.75%.

It is worth recalling that in August, the regulator already lowered the rate by 25 basis points, marking the first easing of its monetary policy since the start of the COVID-19 pandemic in March 2020. At that time, the rate was at 0.1% and remained at that level until November 2021, after which the Bank of England began raising it to combat inflation. In August last year, the interest rate peaked at 5.25%.

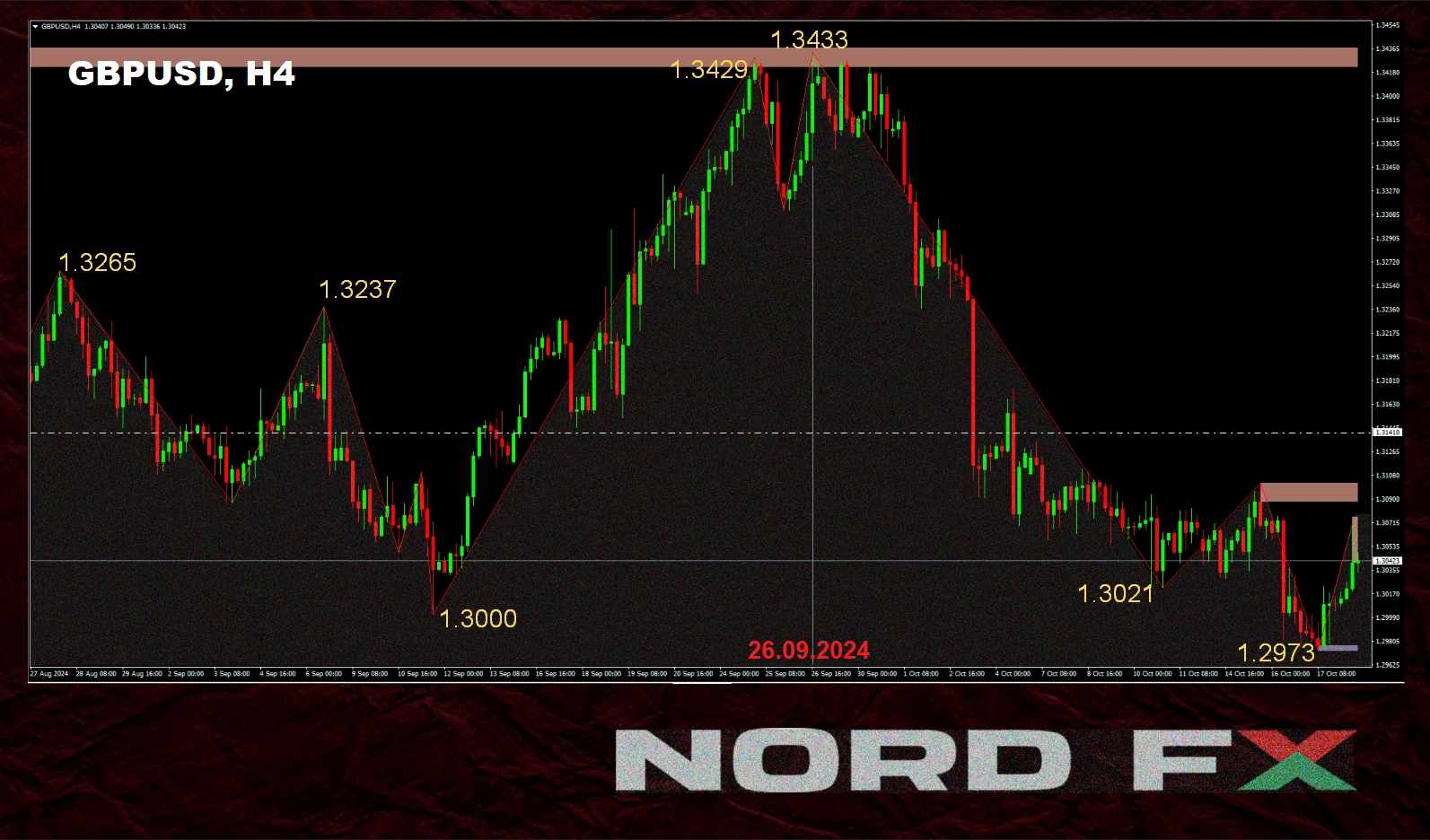

This tightening of monetary policy had a positive effect, bringing inflation down from 11.1% in November 2022 to the current 1.7%. This success allows the BoE to continue on the path of easing monetary policy, shifting its focus to supporting economic growth, but at the same time, it pushes the GBP/USD pair lower. In light of recent events, the British currency plummeted to 2-month lows, reaching a local bottom at 1.2973 on 17 October.

● Among the key events and publications concerning the state of the UK economy in the upcoming week are the speeches by Bank of England Governor Andrew Bailey on 22 and 23 October. On Thursday, 24 October, business activity data (PMI) will be released, along with the Inflation Report hearing in the United Kingdom. The week will conclude with another speech by Mr. Bailey, scheduled for Saturday, 26 October.

CRYPTOCURRENCIES: Four Reasons for Bitcoin's Rise

● The cryptocurrency exchange CoinEx published a report on the cryptocurrency market for September 2024. According to the exchange's analysts, the main event—one with which it is hard to disagree—was the Federal Reserve's 50 basis point interest rate cut. This move delighted investors and triggered another wave of risk appetite. Stock indices such as the S&P 500 reached new highs, followed by a rise in cryptocurrencies. The European Central Bank (ECB) and the Bank of England (BoE) also contributed to this process by steering towards monetary policy easing (QE).

The bull rally of the leading cryptocurrency began on 7 September at the $52,554 level. After the Fed's decision on 18 September, bitcoin surged to $66,517 and ended the month at $62,396.

● On Monday, 14 October, the price of bitcoin surged above $65,000. Then, on 16 October, a local high of $68,437 was recorded, a level the leading cryptocurrency had last reached on 29 July. As previously mentioned, the positive dynamic was influenced by the rise in US stock indices. Another driver was the anticipation of further stimulus measures by Chinese authorities to support the national economy.

Analysts point to two more reasons that pushed bitcoin upwards. The first was the news that the crisis managers of the bankrupt crypto exchange Mt.Gox postponed their plans to return stolen bitcoins to creditors by a year. According to some reports, Mt.Gox held around $10 billion worth of bitcoins. Payouts to creditors began in July this year, with plans to complete them in the coming months. The release of such a large number of coins into the market could have significantly depressed bitcoin prices. However, it has now been revealed that the distribution of tokens will not be completed until the end of October 2025, thus averting a potential price dump for this reason.

● And finally, reason number four. It was the speech made on Monday, 14 October, by US presidential candidate Kamala Harris, in which she promised to support a regulatory framework for cryptocurrencies. The details of her plan are still unknown, and it is possible that this is merely election rhetoric. However, this promise has sparked some hope that Harris may not continue Biden's strict policy towards the digital industry. According to media reports, if elected president, she plans to stimulate Black crypto investors through the "Black People Opportunities Programme." It is expected that this initiative could affect more than 20% of Black Americans who currently hold cryptocurrencies.

● Analysts note that similar price movements for bitcoin were observed ahead of the 2016 and 2020 US presidential elections. In 2016, BTC traded within a very narrow range for over three months. However, three weeks before the election, it began to rise, doubling in value by the start of 2017.

A similar pattern occurred in 2020: first, sideways movement for half a year, followed by a bull rally starting three weeks before the election. As a result, after starting at $11,000, the flagship cryptocurrency nearly tripled in value to $42,000 by early January. If something similar happens this time, it is possible that bitcoin could enter the New Year 2025 in the $120,000–180,000 range.

● The trader and analyst known by the nickname Stockmoney Lizards believes that before the next pump, BTC is likely to see a correction into the $63,000–63,600 zone. "Bitcoin is entering the Fear of Missing Out [FOMO] zone," writes Stockmoney Lizards. "At some point, a temporary correction will begin, and traders caught in the FOMO will have their positions liquidated before the upward movement resumes."

Stockmoney Lizards’ colleagues also note that despite the recent rise in bitcoin, the price has not yet managed to solidify above the upper boundary of the descending channel that began on 14 March. Currently, this boundary sits at $68,050. Meanwhile, the CoinEx Research team identifies $70,000 as the critical level.

● Analysts at CryptoQuant believe that the fear of another drop (FOMO) among small retail investors is benefiting large players who are not concerned with the short-term fluctuations in the price of the leading cryptocurrency. "The accumulation of bitcoins by whales in the $54,000 to $68,000 price range is a significant indicator. New whales are entering the game and actively accumulating, while existing ones are increasing their positions. Overall, all whales are accumulating in this price zone. Their growing balances suggest potential growth on the horizon, whether in the medium or long term," states the CryptoQuant report.

"Bitcoin has been trading in a narrow range for seven months now," the experts add, "and the longer this period lasts, the more powerful the rally of the first cryptocurrency and the overall market capitalization of the crypto market could be."

● At the time of writing this review (18 October, 12:00 CET), the BTC/USD pair is trading around the $67,800 zone. The overall cryptocurrency market capitalization has increased to $2.33 trillion (up from $2.20 trillion a week ago). The Bitcoin Fear & Greed Index has surged from 32 to 73 points, skipping the Neutral zone and moving directly from the Fear zone to the Greed zone.

● And to conclude the review, here are a few pleasant numbers for bitcoin enthusiasts. There's a physicist and financial analyst named Giovanni Santostasi (his surname somewhat resembles the name of bitcoin's creator, Satoshi). In 2018, this scientist applied the Power Law to calculate the price trajectory of the leading cryptocurrency. To explain briefly: Power Law is a relationship between two quantities where a change in one causes a proportional change in the other, expressed by a power function. Santostasi used this law to model the relationship between bitcoin’s price and time.

We won't burden the reader with formulas. However, according to Santostasi’s calculations, by the start of 2030, the price of BTC should range between $174,500 and $1.49 million. Ten years later, by the beginning of 2040, the price could even reach $10 million, and it should not fall below $1.6 million. That said, Giovanni Santostasi himself warns that the market conditions could change significantly over the next 16 years, meaning that actual figures might differ greatly from these estimates.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.