First, a review of last week’s events:

- EUR/USD. According to Bank of America Merrill Lynch, the most popular strategy in the market after “buy shares” is “sell the dollar”. Speculative short positions in this currency have risen to a two-year high. The USD index (DXY) has fallen below 90, while it was at 102.82 on March 15, 2020. As for the retreat of the dollar in recent days, it is taking place against the background of the discussion in the US Congress of an additional package of fiscal stimuli. After all, every new dollar poured into the country's economy will lead to a decrease in its purchasing power.

The Federal Reserve meeting held on Thursday, December 17 had virtually no effect on market sentiment. The interest rate remained at the same level, and, one might say, a blissful pre-Christmas mood prevailed at the press conference: nothing new was said about the prospects for further quantitative easing and no worries about the current state of the economy were voiced. Although, perhaps, such passivity was caused not only by Christmas, but also by the change of the US President. The new owner has not yet settled in the White House. And the old one is already a duck lame on both legs.

True, thanks to the hopes of investors for the future growth of the S&P500 and for a positive outcome of the Brexit negotiations, the EUR/USD pair still continued its movement northward, adding about 140 points in a week. As for the final chord, it sounded at the height of 1.2250; - GBP/USD. With the weakening USD and hopes that the Brexit talks will succeed at the last moment, the pair continues to push higher. At the week's high, December 17, it reached 1.3625, showing a gain of as much as 400 points. However, then a correction followed, and it completed the five-day period just below the level of 1.3500.

Belief in the deal is fueled by media reports that the fishing problem in British waters remains the last hurdle. The markets were encouraged by the statements of the head of the European Commission, Ursula von der Leyen, who said that there is a "narrow path" to the agreement, as well as European Commissioner for Internal Trade Michel Barnier, who confirmed that "the possibility of a trade agreement remains."

Britain also seems to agree to the deal, but, as it was stated, "not at the cost of sovereignty, and control should include the sea as well." Prime Minister Boris Johnson has threatened to keep European fishermen out of British waters for at least eight years if his three years quota fishing proposal is not accepted.

In general, Hamlet's question “To be or not to be?”, which has been sounding for 420 years, as applied to Brexit, is still open; - USD/JPY. The yen is stable, US Treasuries remain in the same trading range, the dollar is weakening, the USD (DXY) index is falling. All this allows the USD/JPY pair to continue its smooth descent within the downstream medium-term channel, which began at the end of last March. On Thursday December 17, it reached the midline of this channel, fixing a weekly low at 102.85. The last point in the five-day period was set at 103.30;

- cryptocurrencies. What has been expected from bitcoin for three whole years has come true. It not only renewed the all-time high, not only broke through the $20,000 level, but also soared in a short period from December 12 to 17 from $18,000 to $23,620, adding more than 30%.

If we compare the rallies in December 2017 and December 2020, the main difference between them, according to many experts, is that in the first case, the main driving force was retail investors, but now it is institutional. According to the analytical company Chainalysis, the "population" of bitcoin whales (1000 BTC and more) has been expanded with 302 new wallets since the beginning of the year and peaked at 2274 at the end of last month, and balances at the corresponding addresses increased by 1.4 million BTC during this time.

To be fair, it should be noted that the number of retail users is also growing. The number of bitcoin addresses with a non-zero balance has approached the mark of 33 million, updating the historical maximum, according to the data of the analytical service Glassnode. The number of wallets with a balance of more than 1 BTC is also steadily growing. The indicator has set a new record at 827,105 recently, recovering from a slight recession at the end of September.

Of course, we have written about this many times, the coronavirus pandemic contributed to the popularization of bitcoin. However, it is probably early to talk about the mass acceptance of cryptocurrencies by the population. So, in a survey conducted by Opinium and AltFi among UK residents, only 10% said they bought a cryptocurrency. And although the results of 2020 can be viewed as an undoubted improvement - a year ago the figure was half as much, 5.3% - it is still a very small percentage, which leaves significant potential for growth in the crypto market, the total capitalization of which reached $670 billion on December 17.

It should be noted that despite the fact that BTC/USD quotes have already by far exceeded the high of 2017, the capitalization has not reached its record value of $830 billion, recorded on 07 January 2018. That is, the rise in the value of bitcoin is fueled by significantly smaller amounts of fiat than before, which may indicate the pair is strongly overbought. This is evidenced by the values of the Crypto Fear & Greed Index, which rose again in seven days from 89 to 95 and is very close to the maximum value of 100 points. But while waiting for a correction, one should take into account that the end of the year is now, the Christmas holidays are coming, and the most unexpected things can happen on the thin market - from zero volatility to new spikes to the north;

As for the forecast for the coming week, summarizing the views of a number of experts, as well as forecasts made on the basis of a variety of methods of technical and graphical analysis, we can say the following:

- EUR/USD. Next week on Thursday, December 24, Forex trading will end at 17:00 CET, and there will be no trading at all on December 25, Christmas. (please visit the NordFX website, the Company News section for details on the trading schedule during the Christmas and New Year holidays in the currency and cryptocurrency markets, as well as on CFD contracts).

The end of the year is a period when big players close their positions, sum up and go on vacation. But it is at this point of low liquidity in the market, as already mentioned above, that traders need to be prepared for sudden surprises. And it is not necessary that they will be as pleasant as gifts from Santa Claus. The main surprise may be the agreement between the EU and the UK on the Brexit terms (or lack thereof).

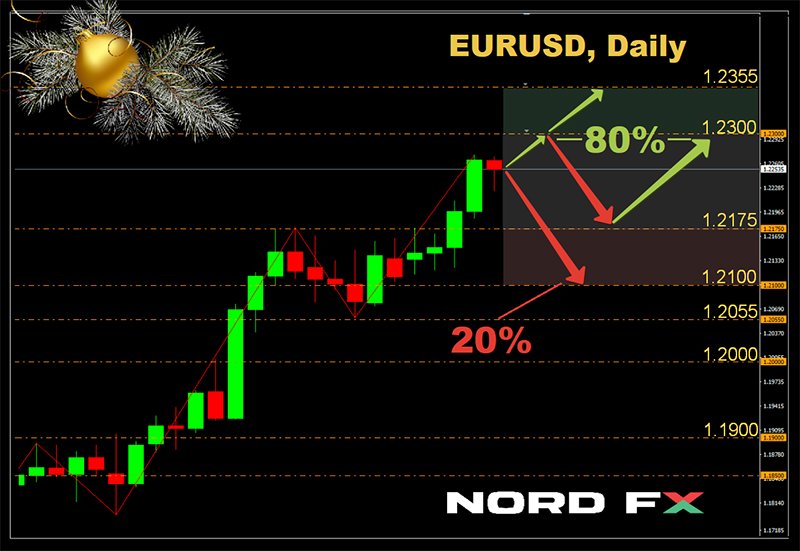

At the time of this writing, 95% of the trend indicators on H4 and 100% on D1 are green. Also, 75% of oscillators on both timeframes look up. However, the remaining 25% signals that the pair is overbought, and a correction is possible.

Graphical analysis on H4 predicts the movement of the pair in the trading range of 1.2175-1.2300, and D1 indicates the possibility of its growth to the height of 1.2355. 80% of experts support this development. The remaining 20% expect the pair to decline to support 1.2100, and in the transition from weekly to monthly forecast, the number of bear supporters increases to 65%. Closest supports are at 1.2055 and 1.1900 levels.

- GBP/USD. As we wrote last week, there are three possible options regarding Brexit.

1 - neutral soft. It is a decision to extend the current terms of the transition period for another six months or a year in order to gradually move to rules similar to the basic rules of the World Trade Organization. In this case, a catastrophic collapse of the pound would be avoided, although the pair would go south. The nearest support level in this case is 1.3275, then 1.3100, 1.3000 and 1.2850.

2 - the “hardest” Brexit, without any agreements or prolongations, which will lead the pair to fall first to the 1.2700 horizon, and over time, possibly to the lows of May 2020. in the area of 1.2075-1.2160.

3 - the conclusion of a full-scale deal between the EU and the UK. In this case, we will see a rise of the pound first to the height of 1.3500, and then perhaps to the highs of 2018 in the area of 1.4350.

We will know soon which of these options will be chosen; - USD/JPY. 90% of oscillators and 100% of trend indicators on D1 are still colored red, expecting further decline in the pair within the descending medium-term channel. As for analysts, they, supported by graphical analysis on H4 and D1, they consider most likely the pair to move in the trading range 102.70-104.00, that is, between the central and upper boundaries of the designated channel;

- cryptocurrencies. So, is it worth waiting for a repeat of the "crypto winter" of late 2017 - 2018? Or, after a slight correction, the BTC/USD pair will again rush to new heights?

Bestselling author of Rich Dad Poor Dad and entrepreneur Robert Kiyosaki is convinced that cryptocurrency will continue to rise to $50,000 next year amid further influx of institutional money. The entrepreneur, having said that “America is in trouble”, precludes the “death” of the US dollar and a “bright future” for gold, silver, bitcoin.

The well-known Dutch cryptanalyst PlanB, who developed the popular BTC stock-to-flow valuation model, believes that the price of the reference cryptocurrency may rise to $100,000 by the end of 2021, and maybe up to $300,000. PlanB admits that his outlook sounds extremely optimistic and even somewhat amusing for some investors. However, the rise in the price of bitcoin in the past allows him to make such predictions.

According to analysts from the financial conglomerate JPMorgan Chase, institutional investors can invest up to $600 billion in the first cryptocurrency in the coming years. This requires that American, European and Japanese insurance companies and pension funds invest only 1% of their assets in bitcoin.

As JPMorgan lead strategist Nikolaos Panigirtzoglou noted, the recent $100 million investment by Massachusetts Mutual Life Insurance Company marks another milestone in the adoption of the first cryptocurrency by such organizations. At the same time, the analyst admits that it is quite difficult for such traditional investors to invest in cryptocurrency, since there are still regulatory requirements for the choice of investment assets in terms of risks and fulfillment of obligations. This can limit the amount of funds available for buying BTC.

In general, the topic of the attitude of government regulators to cryptocurrencies is one of the key factors for the development of this market. This issue has been actively discussed at the recent BlockShow conference. The speakers said that although decentralized finance needs to communicate with regulators, it cannot be full concessions to them. If we introduce complete regulation of the market, then it will hardly differ from fiat.

Now about the prospects of the BTC/USD pair for the next few weeks. According to the average forecast, the probability of its rise to $25,000-26,000 is estimated at 30%, above $30,000 - 10%. As for the fall, the probability that the pair will decrease to the $18.500-20,000 zone is 20%.

As for altcoins, those who at this stage are wary of investing in bitcoin may pay attention to ethereum. If BTC has already exceeded its 2017 high by 16%, then ETH is still to grow from its current values in the region of $670 to its all-time high of $1,420. And this despite the fact that this main altcoin showed better dynamics than bitcoin this year: it has added 640% from the March low against 465% for BTC.

In addition, altcoin blockchain No.1 has recently been updated. Ethereum 2.0 has made the cryptocurrency safer, more efficient, scalable and, hopefully, potentially more profitable.

And here it is necessary to recall the recent warning of the co-founder of ethereum Vitalik Buterin, who urged not to get into debt or take out loans to buy any digital assets, be it bitcoin, ethereum or any other coins. He said he had “only a few thousand dollars of net equity” before Ethereum was created. “However, I sold half of my bitcoins to be sure I would not break up if the rate fell to zero,” he writes.

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

Go Back Go Back