EUR/USD: Is the Dollar's Growth Over?

- Has the dollar rally come to an end? The answer to this question sounds more and more affirmative day by day. The reason for the weakening of the US currency lies in the interest rate of the Fed. This, in turn, depends on the state of the labor market and inflation in the US, which determine the regulator's monetary policy.

Recent data have shown that the labor market is doing well at least. The number of new jobs created outside the US agricultural sector (NFP) was 261K in October, which is higher than the forecast of 200K. Although the number of initial jobless claims increased, the growth was insignificant and, with the forecast of 220K, it actually amounted to 225K (218K a month ago).

As for inflation, the data published on Thursday, November 10, turned out to be much better than both previous values and forecasts. Core consumer inflation (CPI) increased by 0.3% in October, which is lower than both the forecast of 0.5% and the previous September value of 0.6%. The annual growth rate of core inflation slowed down to 6.3% (against the forecast of 6.5%, and 6.6% a month ago).

This rate of change in CPI is the slowest in the last 9 months and suggests that a series of sharp interest rate increases have finally had the desired effect. Market participants have immediately decided that the Fed is now likely to slow down the pace of interest rate increases. As a result, the DXY Dollar Index went into a steep peak, losing 2.1%, which was a record drop since December 2015.

The probability that the US Federal Reserve will increase the rate by 75 basis points (bp) at the next December meeting of the FOMC (Federal Open Market Committee) is now close to zero. The futures market expects it to rise by only 50 bp. The maximum value of the rate in 2023 is now predicted at 4.9%, and it can be reached in May (a forecast a week ago predicted a peak of 5.14% in June).

All this does not exclude a new wave of dollar strengthening in the coming months of course. But much will depend on the geopolitical situation and the actions of other regulators. Many analysts believe that a slowdown in the pace of monetary tightening by the Fed (QT) will allow rival currencies to counter the dollar more effectively. The Central Banks of other countries are currently playing the role of catching up, not having time to raise their rates at the same pace as in the United States. If the Fed moves more slowly (and at some point, slows down altogether), they will be able, if not to overtake their American counterpart, at least to close the gap or catch up with it.

Here we can cite the Eurozone as an example. According to preliminary Eurostat data for October, inflation here reached a record 10.7%. And this despite the fact that the target level of the ECB is only 2.0%. So, as stated by the head of the European Central Bank, Christine Lagarde, the regulator has no choice but to continue to raise rates, even despite the slowdown in economic growth.

The change in market sentiment resulted in a northward reversal of the EUR/USD pair. It was trading in the 0.9750 zone just a week ago, on November 04, and it fixed a local maximum at the height of 1.0363 on Friday, November 11. The last chord of the five-day period sounded almost nearby, at the level of 1.0357.

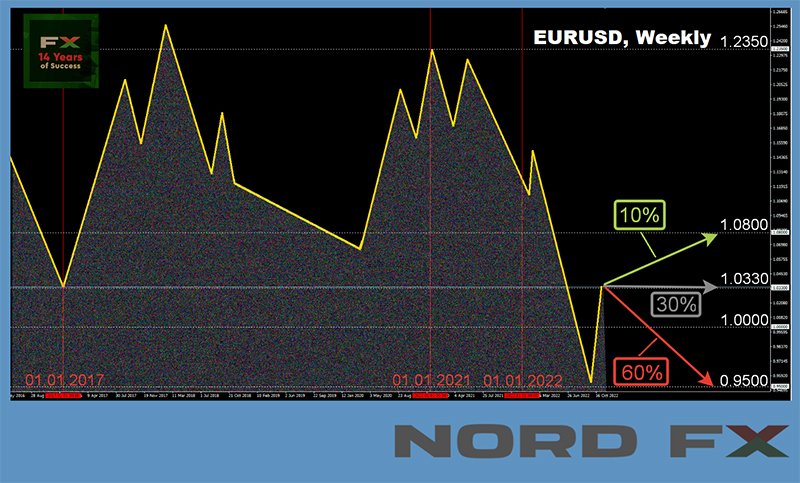

Most analysts expect the pair to return to the south in the near future, 60%, and only 10% expect further movement to the north. The remaining 30% of experts point to the east. The picture is different among the oscillators on D1. All 100% of the oscillators are colored green, while a third of them are in the overbought zone. Among trend indicators, the green ones also have an advantage: 85% advise buying the pair and 15% advise selling. The immediate support for EUR/USD is at 1.0315, followed by the levels and zones at 1.0254, 1.0130, 1.0070, 0.9950-1.0010, 0.9885, 0.9825, 0.9750, 0.9700, 0.9645, 0.9580, and finally the September 28 low of 0.95. The next target of the bears is 0.9500. Bulls will meet resistance at levels 1.0375, 1.0470, 1.0620, 1.0750, 1.0865, 1.0935.

Highlights of the upcoming week include the release of preliminary Eurozone GDP data on Tuesday November 15. The ZEW Economic Sentiment Index in Germany and the Producer Price Index (PPI) in the US will be announced on the same day. Data on retail sales in the US will arrive on Wednesday, October 16, and the market will be waiting for the publication of such an important inflation indicator as the Consumer Price Index (CPI) in the Eurozone on Thursday, October 17. In addition, ECB President Christine Lagarde is scheduled to speak on November 16 and 18.

GBP/USD: UK Economy Plunged into Recession

- Recall that the Bank of England (BoE), raised the key rate by 0.75%, from 2.25% to 3.00%, at its meeting on November 3, as well as the Fed. This move was the strongest one-time rate hike since the late 1980s. At the same time, the head of the Bank of England (BoE), Andrew Bailey, said on Friday November 11 that "more interest rate hikes are likely in the coming months" and that "efforts to curb inflation are likely to take from 18 months to two years." Silvana Tenreiro, a member of the Monetary Policy Committee of the British Central Bank, announced approximately the same dates. According to her, monetary policy will have to be loosened, possibly in 2024.

However, it is not yet clear when and how much the BoE will raise the pound rate. The United Kingdom's GDP data released last week, although below the forecast of -0.5%, still moved into the negative zone, showing a drop in the economy in Q3 by -0.2%. This was the first fall in 6 quarters, and it looks like it started the country's plunge into a long recession, which, if quantitative tightening (QT) continues, according to the Bank of England, could last about 2 years.

Economists at Bank of America Global Research analyzed how energy prices and the pace of Central bank policy normalization will affect G10 currencies. As a result, they concluded that the dynamics of the balance of payments will be a deterrent for currencies such as the euro, the New Zealand dollar and the British pound in 2023.

In the meantime, against the backdrop of data on slowing inflation in the US, GBP/USD, as well as EUR/USD, went up, adding almost 555 points over the week and reaching the weekly high at 1.1854. The final point of the trading session was set at 1.1843. And, according to the strategists at the American investment bank Brown Brothers Harriman (BBH), the pound may soon test the August 26 high at 1.1900.

As for the median forecast of analysts for the near future, here the bulls have received 25% of the vote, the bears 35%, and the remaining 40% of experts prefer to remain neutral. Among the oscillators on D1, 100% are on the green side, of which 25% signal that the pair is overbought. Among trend indicators, the situation is exactly the same as in the case of EUR/USD: 85% to 15% in favor of the greens. Levels and zones of support for the British currency: 1.1800-1.1830, 1.1700-1.1715, 1.1645, 1.1475-1.1500, 1.1350, 1.1230, 1.1150, 1.1100, 1.1060, 1.0985-1.1000, 1.0750, 1.0500 and the September 26 low of 1.0350. When the pair moves north, the bulls will meet resistance at the levels 1.1900, 1.1960, 1.2135, 1.2210, 1.2290-1.2330, 1.2425 and 1.2575-1.2610.

Of the events of the upcoming week, data on unemployment and wages in the UK, which will be released on Tuesday 15 November attract attention. The value of the Consumer Price Index (CPI) will become known the next day, on Wednesday, November 16, and the UK Inflation Report will also be heard. And data on retail sales in the United Kingdom will be published at the very end of the working week, on Friday, November 18.

USD/JPY: The Yen's Strength Is the Weak Dollar

- it is evident that the fall of the dollar has not bypassed USD/JPY which, as a result, returned to the values of late August - early September 2022. The low of the week was recorded on Friday, November 11 at 138.46, and the finish was at 138.65. It is clear that the reason for such dynamics was not the strengthening of the yen and not the currency interventions of the Bank of Japan (BoJ), but the general weakening of the dollar.

Recall that after USD/JPY reached 151.94 on October 21, hitting a 32-year high, the BoJ sold at least $30bn to support its national currency. And then it continued to intervene.

Finance Minister Shinichi Suzuki said on November 4 that the government has no intention to send the currency to certain levels through intervention. And that the exchange rate should move steadily, reflecting fundamental indicators. But the dollar has now retreated by almost 800 points in just a few days without any financial costs from the Bank of Japan, without any fundamental changes in the Japanese economy. And this happened solely because of expectations that the Fed could reduce the rate of interest rate hikes.

What if it doesn't reduce it? Will the Japanese Central Bank decide on one or more interventions? And will it have enough money for this? The second tool for supporting the yen, the interest rate, can probably be forgotten, since the Bank of Japan is not going to depart from the ultra-dove exchange rate and will keep it at a negative level -0.1%.

The fact that the dollar will soon try to win back at least part of the losses and USD/JPY will turn to the north is expected by 65% of analysts. The remaining 35% vote for the continuation of the downtrend. For oscillators on D1, the picture looks like this: 80% are looking south, a third of them are in the oversold zone, 20% have turned their eyes to the north. Among the trend indicators, the ratio of green and red is 15% to 85% in favor of the latter. The nearest strong support level is located in the zone 138.45, followed by the levels 137.50, 135.55, 134.55 and the zone 131.35-131.75. Levels and resistance zones: 139.05, 140.20, 143.75, 145.25, 146.85-147.00, 148.45, 149.45, 150.00 and 151.55. The purpose of the bulls is to rise and gain a foothold above the height of 152.00. Then there are the 1990 highs around 158.00.

As for the release of macro statistics on the state of the Japanese economy, we can mark Tuesday, November 15 next week, when the data on the country's GDP for Q3 2022 will become known. According to forecasts, GDP will decrease from 0.9% to 0.3%. And if the forecast comes true, it will become another argument in favor of keeping the interest rate by the Bank of Japan at the same negative level.

CRYPTOCURRENCIES: Two Events That Made the Week

- The past week was marked by two events. The first plunged investors into incredible melancholy, the second gave hope that not everything is so bad. So, one at a time.

Event No. 1 was the bankruptcy of the FTX exchange. After it became known about the liquidity crisis of Alameda Research, a crypto trading company owned by FTX CEO Sam Bankman-Fried, Binance CEO Chang Peng Zhao published a message about selling FTT tokens. Recall that FTT is a token created by the FTX team, and Chang Peng Zhao’s actions immediately led to a rapid drop in its value. FTX users began to massively try to withdraw their savings. About a billion dollars in cryptocurrency and stablecoins were withdrawn from the exchange, and its balance became negative. In addition to FTT, the price of Sol and other tokens of the Solana project, which is linked to both FTX and Alameda, fell sharply as well.

Other cryptocurrencies have also been affected by the decline. Investors do not like to see any failure in any risky asset, and they fear the domino effect when the collapse of one company threatens the existence of others.

Encouraging information came from the head of Binance: Chang Peng Zhao announced on November 08 that his exchange was going to buy the bankrupt FTX. (According to some estimates, the "hole" in its budget is about $8 billion). However, it turned out later that the deal would not take place. Quotes fell further down. As a result, bitcoin sank in price seriously, falling by almost 25% by November 10: from $20,701 to $15,583. Ethereum "shrunk" by 32%, from $1,577 to $1,072. The total capitalization of the crypto market has decreased from $1.040 trillion to $0.792 trillion.

There is no doubt that the collapse of FTX will increase the regulatory pressure on the entire industry. In the previous review, we started to discuss the question of whether the regulation of the crypto market is a good thing or a bad thing. It should be noted that the majority of institutions vote for regulation. For example, BNY Mellon, America's oldest bank, said that 70% of institutional investors can increase their investment in cryptocurrency, but at the same time they are looking for ways to safely enter the crypto market, and not mindlessly invest money in the hope of high profits.

Approximately the same has recently been stated by Mastercard Chief Product Officer Michael Miebach. In his opinion, this asset class will become much more attractive to people as soon as the supervisory authorities introduce the appropriate rules. Many people want but do not know how to enter the crypto industry and how to get the maximum protection for their assets.

As for the event No. 2 mentioned at the beginning of the review, it was the publication of inflation data in the US on Thursday, November 10. As it turned out, it is declining, from which the market concluded that the Fed may reduce the pace of raising interest rates. The DXY dollar index went down immediately, while risky assets went up. Correlation between cryptocurrencies and stock indices S&P500, Dow Jones and Nasdaq, lost at the time of the FTX crash, has almost (but not completely) recovered, and the quotes of BTC, ETH and other digital assets also began to grow.

At the time of writing this review, Friday evening, November 11, BTC/USD is trading in the $17,030 area, ETH/USD is $1,280. The total capitalization of the crypto market is $0.860 trillion ($1.055 trillion a week ago). The Crypto Fear & Greed Index fell back into the Extreme Fear zone to 21 points in seven days.

Cumberland, the crypto arm of venture capital firm DRW, believes a "promising uptrend" is emerging in the volatile digital asset market. “The dollar's seemingly inexorable rally ended up killing sentiment in all major risk asset classes earlier this year,” the firm said. “This rally seems to have peaked, probably as a result of expectations that the Fed will change course by mid-2023.”

Having analyzed bitcoin’s previous price action, including its upper highs and lower lows since November 2021, crypto analyst Moustache concluded that the cryptocurrency has displayed a “bullish megaphone pattern.” In his opinion, the expanding model, which looks like a megaphone or an inverted symmetric triangle, indicates that bitcoin could reach $80,000 around the summer of 2023.

As for the shorter-term outlook, some analysts believe that bitcoin could regain a critical support level by the end of 2022 and possibly even regain its $25,000 high.

The total volume of lost bitcoins, as well as digital gold in the wallets of long-term crypto investors, has reached a five-year high. This means that the active market supply of cryptocurrency is decreasing, promising optimistic prospects for prices, provided that demand increases or remains constant.

According to billionaire Tim Draper, women will be the main driver of the next bull market, as they control about 80% of retail spending. “You can’t buy food, clothes and housing with bitcoin yet, but once you can, there will be no reason to hold on to fiat currency,” he said, predicting the price of the first cryptocurrency to rise to $250,000 by mid-2023. It should be noted that this prediction is by no means new. Back in 2018, Draper predicted bitcoin at $250,000 by 2022, moved the forecast to early 2023 in the summer of 2021, and extended it now for another six months.

And finally, some information from the criminal world. Moreover, it concerns not only the future, but also the past and present, and is important for each of us. The Australian Securities and Investments Commission (ASIC) has studied cases of cryptocurrency fraud and has divided them into three categories. The first relates to fraud, where the victim believes they are investing in a legitimate asset. However, the crypto app, exchange, or website turns out to be fake. The second category of scams involves fake crypto tokens used to facilitate money laundering activities. The third type of fraud involves the use of cryptocurrencies to make fraudulent payments.

ASIC says the top signs of a crypto scam include “getting an offer out of the blue,” “fake celebrity ads,” and asking a “romantic partner you only know online” to send money in crypto. Other red flags include asking to pay for financial services in crypto, asking to pay more money to access funds, withholding investment profits "for tax purposes" or offering "free money" or "guaranteed" investment income.

In general, as Adventus Caesennius, legate of the Imperial Legion from the computer game The Elder Scrolls V: Skyrim, said: “Keep your vigilance. It will pay off sooner or later."

NordFX Analytical Group

Notice: These materials are not investment recommendations or guidelines for working in financial markets and are intended for informational purposes only. Trading in financial markets is risky and can result in a complete loss of deposited funds.

திரும்பிச் செல்லவும் திரும்பிச் செல்லவும்